TIA Releases Q324 Market Report: Industry Sees Small Growth in Shipments, Revenue over Previous Quarter

The TIA Q3 2024 3PL Market Report highlights a mix of trends across transportation modes and company sizes. Key findings include a slight quarter-over-quarter increase in total shipments and revenue, persistent pricing pressures affecting margins, and varied performance across truckload (TL), less-than-truckload (LTL) and intermodal (IM) sectors.

Smaller firms achieved notable volume growth but faced significant margin declines, while larger companies maintained steadier profitability.

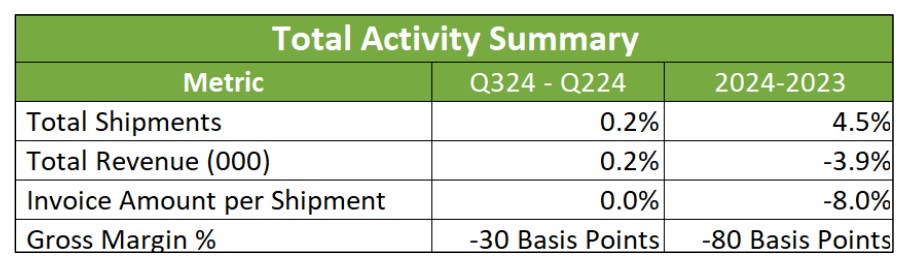

Quarter-over-quarter (QoQ), total shipments and revenue increased slightly by 0.2%, with invoice amounts per shipment remaining unchanged. However, gross margin percentage declined by 30 basis points, signaling profitability pressures. Year-over-year (YoY) comparisons showed a 4.5% increase in shipments, contrasted with a 3.9% revenue decline because of an 8.0% drop in invoice amounts per shipment and an 80-basis-point reduction in gross margin percentage. These figures indicate volume growth offset by continued pricing pressures.

Truckload (TL) transportation experienced steady QoQ growth of 0.4% in shipments, though invoice amounts and gross margin per load declined marginally. Year-over-year, TL shipments rose 4.4%, but invoice amounts per load dropped 3.6%, and gross margin per load fell 8.9%. Over the past eight quarters, TL metrics show a consistent downward trend in both invoice amounts and margins, although a slight stabilization was noted in Q3 2024.

Less-than-truckload (LTL) saw a 1.4% decline in shipments QoQ, accompanied by a 2.0% reduction in invoice amounts. Despite this, margins improved by 40 basis points to 20.3%, showcasing resilience in profitability. Year-over-year, shipments increased by 1.9%, but profitability softened, with both invoice and margin amounts per load declining by 3.7%. Over the past eight quarters, LTL margins have remained stable despite fluctuations in revenue and volume.

Intermodal (IM) transportation reported a 0.2% QoQ increase in shipments and a 4.3% rise in invoice amounts per load. However, margins declined significantly by 320 basis points to 11.0%. Year-over-year, IM shipments increased by 6.2%, though revenue per load fell by 9.1%, resulting in slight margin pressure. These trends reflect sustained pricing and profitability challenges over the past two years.

Performance by company size revealed contrasting trends. Small companies (<$16M) led growth with a 4.1% QoQ revenue increase and a 13.9% YoY gain. However, they faced significant margin pressures. Midsized companies ($16M–$100M) experienced steady shipment growth but saw margin declines of 4.3% QoQ and 6.0% YoY. Large companies (>$100M) exhibited stability in shipment volumes, with only minor reductions in revenue and margins.

Overall, the Q3 2024 market report underscores a dynamic 3PL landscape marked by volume growth and persistent pricing pressures. Truckload and LTL modes demonstrated resilience, while intermodal faced sharper profitability challenges. Smaller firms achieved notable volume expansion but struggled with declining margins, whereas larger firms maintained steadier profitability. These insights emphasize the need for strategic adjustments to navigate an increasingly competitive market environment.

For more information about subscribing to the TIA Market Report, click here.